Resource: The beginners guide to investing in start-ups

Where start and how to begin your search for the next "big thing" in tech

DISCLAIMER: My newsletter is not intended as financial advice and should not be interpreted as such. I’m merely using this newsletter as a vehicle to share information. I strongly advise you discuss any investment decisions with a financial advisor.

I’m continuing the investment series to focus on conducting market research. This information can be used as a guide to facilitate with helping you understand the industry you’re investing in. After reading the newsletter, you should have a better idea on how to strategically capitalize on opportunities, narrow your focus down to sectors, markets, products and services.

For example, what if you were interested in investing into health tech companies. The first thing I would suggest is to research the biggest technological advancements for health care in the last decade. Technological innovation continues to evolve in all industries. What you’re looking for is how these companies are poised to address health problems? How are companies using technology to reach low-income, diverse populations and how they’re moving the needle towards reducing health expenditures and improving health outcomes? For illustrative purposes, I am going to use the property technology industry as an example for conducting research.

Here’s an outline to help you get started with conducting research:

What is Property technology and how does it work?

An overview of what PropTech is

Property Technology (also referred to as “Proptech”) uses innovative technology to optimize the way people search, rent, buy, sell, and manage properties. By using technology, real estate professionals, developers, investors and property management companies are able to streamline processes and systems, enabling property technology users the ability to work more efficiently and effectively.

Now that you have an understanding of what property technology is and who it is designed for, let’s discuss the areas of the real estate industry that may use and or benefit from implementing the technology in practical ways.

Key areas of the real estate industry

Proptech falls under two major subdivisions: Commercial and Residential. Each category below represents the variety of products and services offered by companies and startups in both the commercial and residential sector of the industry.

Commercial real estate tech:

Listing and search

Leasing management software

Marketplaces

Investment/crowdfunding

Property information

Data, valuation and analytics

Occupier to occupier services

Mortgage tech

Tech-enabled brokerage

Property/building management

Virtual viewing

For residential:

Listing and search services

Agent matching

Marketplace

Broker-free list and search

Investment/crowdfunding

Property information

Data, valuation and analytics

Occupier to occupier services

Mortgage tech

Tech-enabled brokerage

Leasing management software

Property management

Virtual viewing

Sales and marketing

Agent services

By breaking down the key areas of the proptech industry, as an investor you can narrow your focus on investing in companies that addresses specific market needs in commercial or residential real estate.

What technological solutions currently exists in the Proptech market?

Property technology advances the lives of consumers through innovative solutions that continue to evolve. We’re seeing an uptick in the market of real estate companies, investors and service providers who are looking to implement business technology to facilitate with increasing efficiency. For businesses, data will drive a transformation in real estate. In the home, Artificial Intelligence as many modern devices are being used in the real estate, and Internet of Things (often referred to as IoT) The Internet of Things connects technology to sensors and machines. An example of connection to devices, Smart Automation.

Smart Home Automation

Smart Home Automation allows users to connect devices via the internet to monitor and control various areas of your house. With a push of a button, you can turn on your lights from anywhere in the world, open your blinds, view surveillance systems. China’s leading the smart home automation market globally. China’s smart home market is expected to reach $48.8 Billion by the year 2027. The growth is attributed to the growing IoT market, government support, and urbanization. The global home automation market is expected to reach $114 Billion by 2025.

Let’s explore the home automation market for a minute. The primary factors driving the home automation market are:

3 primary factors driving the home automation market:

· People having access to more disposable income, including in developing countries.

· The growing adoption of smartphones and tables across the world

· The adoption to cloud-based solutions used in smart home appliances.

What are some of the Smart Solutions in the market?

· Smart lighting

· Smart thermostats

· Window Sensors

· Security Cameras

· Door control, with the ability to open, close and lock doors

3d technology boosts real estate market with Virtual Tours

Another surprising technological advancement is the increase of Virtual Tours. Virtual tours saw an uptick of users during covid, as homeowners and investors used the technology to facilitate in buying and selling real estate. In fact, over the last 5 years, virtual tours have increased 43%. Earlier this year, Zillow unveiled its latest technology, 3D Home. The software enables users to shop for homes remotely and view floor plans, footage, including square footage to help home buyers get a better feel of the space, prior to purchase.

Virtual tour statistics that may interest you regarding virtual tours:

Customers aged 18 to 34 are 130% more likely to book a place if there is a virtual tour.

50% of adult users on the internet rely on virtual tours in their research and decision-making process.

Customers spend 5 to 10 times more on websites with virtual tours.

67% of people want more businesses to offer virtual tours.

There are more than 5 million visits daily on worldwide virtual tours.

Virtual tours increase a business listing’s interest by two-fold.

Machine Learning

Remember how I mentioned earlier about how data will transform the real estate industry? Machine Learning is one of those transformative technological advancements facilitating with analyzing data.

Machine Learning, real estate and the big data landscape

The fast-growing startup company, HouseCanary is becoming an industry leader in predicting housing market activity through machine learning. Founded in 2013, valuation-focused real estate brokerage HouseCanary provides software and services to reshape the real estate marketplace. Financial institutions, investors, lenders, mortgage investors, and consumers turn to HouseCanary for industry-leading valuations, forecasts, and transaction-support tools. These clients trust HouseCanary to fuel acquisition, underwriting, portfolio management, and more. HouseCanary has built its reputation on “Big Data”; real estate analytics refined through machine learning.

Zillow’s Zestimate software is a free tool to estimate the market value of real estate. Zestimate’s software uses big data, to assess market values from public property records, tax records, recent home sales, and user-submitted information to determine the estimated market value of a home. It is not an official appraisal however, it allows buyers and sellers to make informed financial decisions in real estate.

Market Analysis Breakdown: Size and Scope of the Real Estate Market

What is the actual investment opportunity in the market and how do you assess this? First, let’s discuss the size and scope of the real estate market. The global real estate tech market is estimated at $521.7B with a projected 8.6% CAGR between 2020 and 2025. Key sectors include commercial real estate, residential real estate, and construction.

Who are the Stakeholders in Protech?

The importance of identifying stakeholder groups, is to strategically develop a process for how to approach engaging with each group, organization, or individual. This is largely dependent upon the outcomes companies need to achieve their goals and the resources available to help achieve them.

In PropTech, there are many stakeholders:

· Building owners

· Tenants

· Investors

· Vendors

· Service providers

With this knowledge, you can assess what solutions founders are building, and for whom as it relates to each stakeholder. From there you can decide what startup company to invest in based on the information provided.

The Future of Real Estate

While it is important to look at the present, the future is also an indicator of where the market is headed. The global impacts of covid-19 have changed the way people live forever. These factors have influenced all aspects of traditional real estate from how people purchase homes, to innovative technology that allows construction teams to work remotely on projects.

Trends that you may want to keep an eye on and future growth opportunities:

Carbon-Footprint reduction

Clean technology facilitates in retrofitting buildings to make them safer.

Smart Automation Software

Smart Automation software allows property owners to make their homes more efficient.

Automation Valuation Models

Automation Valuation Models are standard for evaluating the value of real estate. With the help of Artificial Intelligence, sellers and buyers receive accurate, predictable home valuations.

Rental Management Software

Rental Management software provides property management companies the ability to manage and track rental activity online.

Who is funding the Proptech industry? Venture Capitalists.

You’re probably wondering how companies are building these innovative solutions. With Venture Capital. Venture Capital investments started at 186 million USD globally in 2011 and grew to 2.67 billion USD by 2016 and 12 billion USD in 2017, according to a report from RE: Tech. Most recently, the Mid-Year 2018 Global Proptech Confidence Index from MetaProp found that “Ninety-six percent of investors plan to make the same or more PropTech investments over the next 12 months; this is up 76 percent from the year before.” Interestingly, a growing percentage of these investments are going towards companies in their growth stage.

Funding to venture-backed proptech companies has surpassed pre-pandemic levels, with construction tech and property management startups leading the way. VC-backed real estate companies have raised $10.6 billion so far this year, up from the $8.3 billion that was raised during the same period last year, and higher than any year in that period in the past decade.

The sectors within proptech to receive significant funding are property management startups ($2 billion YTD) and construction ($1.9 billion). The largest funding rounds this year for proptech companies so far are ServiceTitan’s $500 million Series F and Loft’s $425 million Series D.

SoftBank was responsible for at least 1.76 billion U.S. dollars in funding for various real estate tech companies in 2018. The largest of these, now defunct Katerra, which received about 865 million U.S. dollars in investment. SoftBank Vision Fund 2 recently led the Series C funding round for Pacaso. — a real estate platform which aims to help people buy and co-own a second home. The company has raised $125 million at a $1.5 billion valuation.

Who are the “big players” in the PropTech industry?

Zumper software helps millions of renters find houses, rooms, condos and apartments for rent. Renters can apply online, and submit rental applications including credit reports. Landlords and Agents use Zumper to manage rentals. The company offers tools to connect landlords and agents to high-quality renters actively searching for housing.

Opendoor is a leading digital platform for residential real estate. The company built an entire platform designed to enhance the consumer real estate experience of buying and selling properties, via mobile devices.

Reonomy is the leading provider of CRE insights, providing top brokerages, financial institutions, and commercial service providers with data and solutions. Reonomy’s enterprise products allows CRE professionals to conduct comprehensive market research, discover new opportunities, aggregate and analyze real estate data.

Guesty is a property management platform for short-term and vacation rentals. The platform provides end-to-end solutions to facilitate in simplifying the complex operational needs of property managers.

Holobuilder is a platform that allows operations, finance, safety, architects, trade partners, inspectors and investors gain remote access to construction sites. The software allows users to see all of the details in real time with a 360 degree view.

Zillow is one of the leading proptech startups in the United States. The company and its affiliates offers customers on-demand experience for selling, buying, renting, and financing real estate.

Insights that may interest you about the Proptech market

KPMG Global PropTech Survey 53% of respondents said Big Data & analytics is emerging technological innovation their business is most likely to adopt in the next 3 years.

92% think digital and technological change will impact their business

86% see digital & technology innovation as an opportunity

49% expect to collaborate with an existing or new supplier to develop their technological innovation capability

89% agree with the statement “Traditional real estate organizations need to engage with PropTech companies in order to adapt to the changing global environment”.

Emerging Leaders in Proptech

As an investor, you don’t just want to pay attention to the companies who are already successful, but the ones who are looking to disrupt what already exists. That’s where the big rewards and risks are in startup investing. Here’s a list of emerging leaders making “waves” in the industry:

Donnel Baird CEO of BlocPower is on a mission to weatherize old, inefficient buildings in underserved communities. BlocPower partnered with Mayor de Blasio in support of a new employment program that will create 1,500 green jobs in Brownsville, South Jamaica, East and Central Harlem and across the Bronx.

Sugar Living

Inspired by the pandemic and its impact on how people felt disconnected due to isolation, Fatima Dicko Launched SugarLiving. Fatima saw an opportunity to create a safe an efficient way for people to feel connected and engaged through the communities in which they reside. The future of living spaces has evolved over the years from smart appliances to building software that enables communities to connect and engage within residential spaces. The future of living begins with community.

SugarLiving helps apartments and residential communities to create better living experiences. Residential communities and apartment buildings can get really creative with how they use the software, from offering experiences to services that provides flexibility and convenience to help residents save time and money.

Relo Move

Founder Tye Calloway, launched Relo a platform that enables people to connect with a community individuals who are relocating, as well as services providers. Users can search for moving services, get quotes, and book services.

Some four million Americans have quit their jobs in April alone, according to the Labor Department https://www.bls.gov/news.release/jolts.nr0.htm People aren’t happy with their respective employers, and have quit jobs for reasons that range from burnout, commuting, low wages, to unhealthy work environments. With more employers offering remote work, we’re seeing an increase of employees moving to affordable cities. Moving to a new city, or state is truly a life changing decision. Every move has its ups and downs. The challenges people face with moving include relocation expenses that may not be fully covered by employers. Choosing the right neighborhood is important for people depending on lifestyle, budget and access to local amenities.

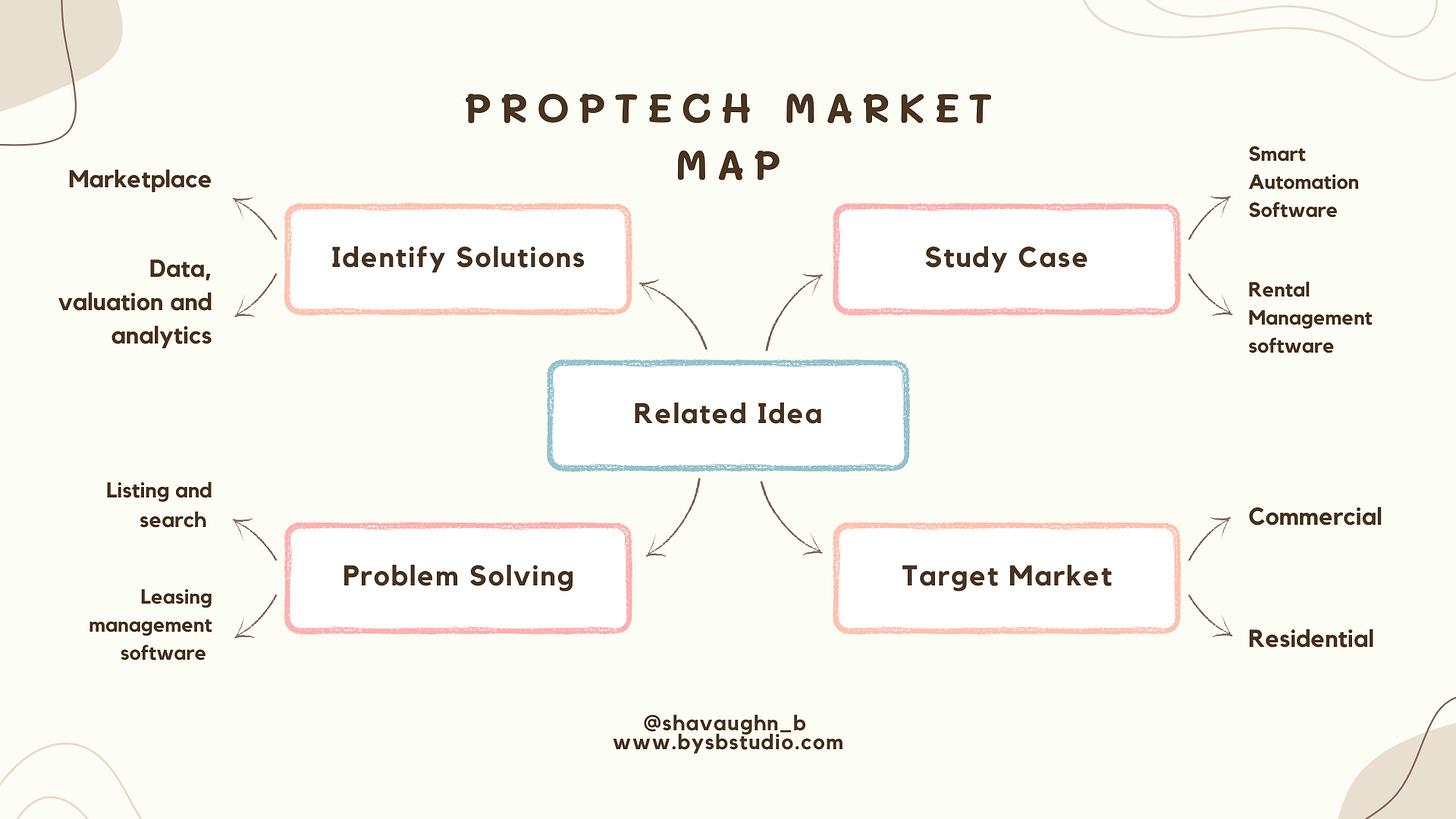

Market Mapping

Once you’ve identified a segment of the market to target, the challenge is to find a startup company that offers the product or service that meets the needs of customers in the target market. A helpful tip for finding investment opportunities is to use a “market map”.

The market map illustrates the categories and or subdivisions that are important to customers. Market Mapping facilitates in identifying gaps in the market, including finding solutions to help meet the needs of consumers.

The strategy for using the tool helps you to learn everything you need to know about the companies you intend to invest in, their competitors, the market, and where the opportunities for disruption could happen.

If you’re looking to invest in startup companies, I encourage you to look at companies dominating markets, while also researching companies that may be under the radar but have the potential to compete in their respective industries. Pick 2-3 markets to research, and deep dive into where there are both gaps and opportunities. This method will facilitate in helping you to develop your knowledge with investing over time, including how to properly source deals and find the right opportunities.

After conducting your own research to identify the market or subdivision to invest in, the next step is to network with Founders, venture capitalists and angel investors. Founders will pitch their business idea to investors for an opportunity to raise capital.

I hope you found this guide to be useful with learning about startup investing!

Shoot me a tweet! Follow me on Twitter! Tell your friends to sign up for my newsletter!

Don’t forget to share the article with your founder friends and investors!

Shavaughn

Founder, BYSB STUDIO

https://www.bysbstudio.com/